8 Simple Techniques For Hard Money Atlanta

Wiki Article

8 Easy Facts About Hard Money Atlanta Shown

Table of ContentsSome Known Facts About Hard Money Atlanta.Hard Money Atlanta Can Be Fun For AnyoneLittle Known Facts About Hard Money Atlanta.Hard Money Atlanta Can Be Fun For AnyoneWhat Does Hard Money Atlanta Do?About Hard Money Atlanta

These jobs are normally completed rapidly, for this reason the demand for fast accessibility to funds. Make money from the project can be used as a down settlement on the following, for that reason, tough cash finances allow capitalists to range and turn even more properties per time. Provided that the taking care of to resale timespan is short (typically much less than a year), home flippers do not need the long-term lendings that standard home mortgage lending institutions provide.

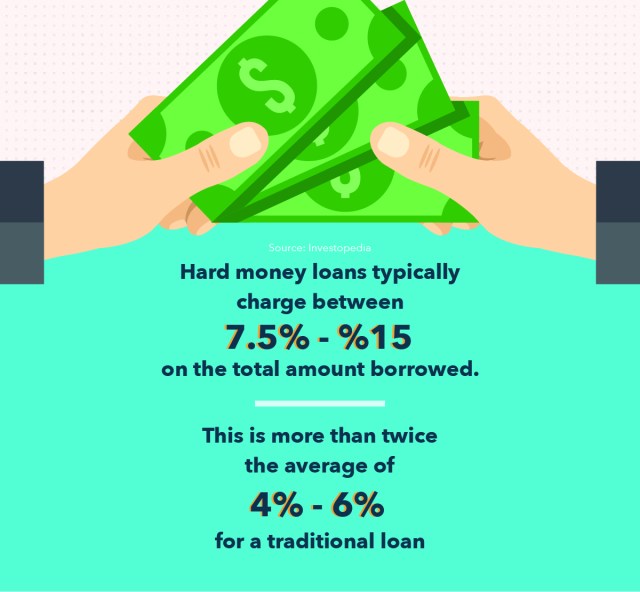

Normally, these variables are not the most important consideration for financing qualification. Rate of interest prices might additionally differ based on the lender as well as the deal in concern.

Get This Report on Hard Money Atlanta

Difficult money loan providers would certainly likewise charge a fee for offering the funding, as well as these charges are likewise called "factors." They usually finish up being anywhere from 1- 5% of the complete finance amount, however, points would generally amount to one percent point of the financing. The significant distinction between a hard cash lending institution and various other loan providers hinges on the approval process.A hard cash loan provider, on the other hand, concentrates on the property to be purchased as the leading consideration. Credit rating, earnings, and also various other individual needs come additional. They also vary in terms of convenience of access to funding as well as rate of interest; hard cash loan providers provide moneying rapidly as well as charge higher rate of interest too. hard money atlanta.

You can discover one in among the following methods: A simple web search Demand recommendations from regional property agents Request referrals from investor/ capitalist groups Considering that the car loans are non-conforming, you need to take your time reviewing the demands and also terms offered before making a determined and also informed decision.

Hard Money Atlanta Things To Know Before You Get This

It is important to run the figures before selecting a hard money car loan to make sure that you do not face any kind of loss. Request your tough cash loan today and get a financing dedication in 1 day.These financings can generally be obtained quicker than a conventional lending, and often without a large deposit. A tough money funding is a collateral-backed car loan, protected by the property being purchased. The size of the loan hop over to these guys is established by the approximated value of the residential property after suggested repairs are made.

Most tough money financings have a term of 6 to twelve months, although in some instances, longer terms can be arranged. The debtor makes a monthly settlement to the lending institution, typically an interest-only repayment. Here's exactly how a typical difficult cash funding functions: The customer wishes to purchase a fixer-upper for $100,000.

A Biased View of Hard Money Atlanta

Maintain in mind that some lenders will need even more cash in the offer, as well Resources as request a minimum down settlement of 10-20%. It can be useful for the investor to choose the lending institutions that need minimal down payment alternatives to decrease their cash money to shut. There will certainly additionally be the typical title fees associated with shutting a purchase.Make certain to talk to the tough money lender to see if there are early repayment charges billed or a minimal return they require. Presuming you remain in the loan for 3 months, as well as the property costs the predicted $180,000, the investor earns a profit of $25,000. If the residential property costs greater than $180,000, the customer makes even more money.

As a result of the shorter term and high passion prices, there normally requires to be restoration as well as upside equity to capture, whether its a flip or rental property. A hard cash finance is suitable for a buyer who wants to fix as well as flip an undervalued property within a fairly pop over here short duration of time.

Our Hard Money Atlanta Diaries

As opposed to the typical 2-3 months to shut a conventional mortgage, a hard money funding can normally be closed within a matter of a pair of weeks or less. Tough money lendings are also excellent for consumers that might not have W2 work or tons of reserves in the bank.Hard money lenders will lend as much money as the rehabbed residential property deserves. In enhancement, some consumers make use of tough money loans to bridge the gap in between the acquisition of a financial investment building and also the purchase of longer-term financing. hard money atlanta. These buy-and-hold financiers use the hard cash to get as well as remodel buildings that they after that refinance with conventional car loans and take care of as rental buildings.

The Single Strategy To Use For Hard Money Atlanta

Customers pay a greater interest rate for a tough cash car loan since they don't have to jump with all the hoops needed by traditional loan providers in addition to getting even more funds in the direction of the acquisition cost and also renovation. Hard cash lending institutions look at the building, along with the consumer's strategies to raise the building's worth and also settle the finance.When using for a hard cash car loan, borrowers require to show that they have adequate funding to successfully get through an offer. (ARV) of the residential or commercial property that is, the approximated value of the property after all enhancements have been made.

Report this wiki page